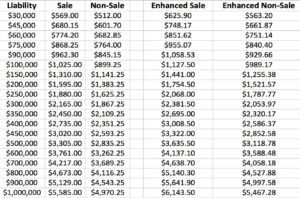

When it comes to the cost of title insurance, it is fairly universal in Pennsylvania. The rates are published by the PLTA (Pennsylvania Land Title Association) as a recommendation and the title industry pretty much follows what they say. For most residential transfers, one usually needs either a lender’s policy or an owner’s policy. There is a slight difference in cost and coverage when you compare them. An Owner’s Policy is a little more expensive but comes with much more research and assurances. (See chart below)

Endorsements

Most banks and investors also require what is known as Endorsements to the policy. An Endorsement is simply added coverage to the basic policy. For instance, in Pennsylvania we are on the metes and bounds system of describing property lines. In western States, they are on a grid system. Many Banks require a survey on the land before they will commit to a loan on it. This is fine in States with the grid system. It is all geometric and cheap and easy to have done. In Pennsylvania, surveying is very costly due to the metes and bounds system, so having one done is very impractical. Therefore, the lender will require a Survey Endorsement to cover certain property line problems that may occur after the fact. Most Title companies charge anywhere from $25 to $100 per endorsement, depending on which endorsements are required. And the Banks usually want anywhere from 2 to 4 endorsements per loan.

Other Fees

There are many other fees that may be associated with title closing cost. The cost of the search performed on the property is usually taken care of by the fee that you are charged for the insurance. However, many times there are other fees that you may be charged for, that are not included in the cost of the policy. If your tax collector, water, sewer or municipality charges a fee for certifications, you will most likely be charge for them as well. If you need a Deed made, it is usually a separate charge. You may also be responsible for the cost of recording a new Deed or Mortgage at the courthouse. And finally, many title companies charge a settlement fee. This is because most closings are not just the simple act of signing papers and having them notarized. There are many technical documents that the signer may need explained and gone over with. Mortgage closers are very knowledgeable and highly skilled in the mortgage industry. The Commitment to a mortgage loan is too huge to blindly sign. Costs for a Mortgage Closing Specialist vary from area to area and also depends on how far the closer has to travel to get to the closing.

And, finally, State and Local transfer taxes may be required for your transaction. These are not a fee from the title company but the title company is required to collect them to give to the state and municipality that govern the land that you own. Most people realize that that when they buy or sell a piece of property, there a taxes to be paid for the transaction. Usually it is 2% of the purchase price which is usually split 50/50 between both parties involved. That is not written in stone but is the normal process. One transfer tax snafu that we see all of the time is when a boyfriend and girlfriend buy a house or land together. It may seem like a good idea at the time but should the relationship sour and one or the other party needs to be removed from the Deed, there will transfer tax that will have to be paid. Even many mortgage consultants don’t realize that this a transfer of ownership and the state will want paid for it. If the couple were married and separating or divorcing, then they would be exempt from the taxes.

Pennsylvania Title Insurance Rates

(Effective July 1, 2012 – Click here or the chart to download the full list)

NOTE: This is a general chart and may be plus or minus a few dollars depending on the purchase price or loan amount.

NOTE: This is a general chart and may be plus or minus a few dollars depending on the purchase price or loan amount.

Please feel free to contact us. We will get back to you with 1-2 business days.